A similar number of mid-tier respondents (61%) found marketing or promotional offers to be nearly as influential as a provider’s reputation when considering switching, compared with just over half of fiber-tier respondents (52%).

While the level of influence of various sources differs by group, your company’s local reputation and the way you frame promotional offers mean everything to customers considering switching.

Help Them Better Understand

Internet providers typically market service plans in basic terms of download and upload speeds. With high-bandwidth internet activities becoming more frequent for households, what else would help communicate the advantages of fiber to customers who are on the verge of switching?

Survey respondents were asked to consider how helpful different types of information would be in selecting the best internet service plan for their home.

Approximately 50% of mid- and fiber-tier respondents stated they would find information that helps them understand their options based on internet speed as the most helpful way to shop. Conversely, around 33% of mid-tier and more than 20% of fiber-tier respondents said they would find information based on common internet activities such as gaming or streaming to be most helpful in guiding their switching decisions.

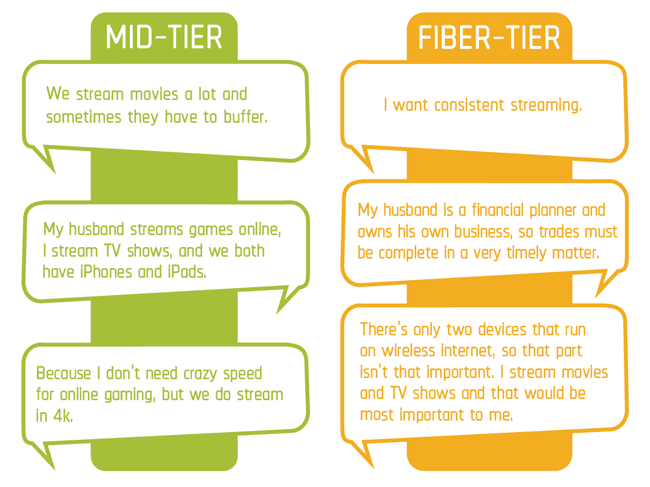

Why Understanding Home Internet Service by Frequent Activities is Helpful

A key takeaway is that neither method of communication should stand on its own. Both mid- and fiber-tier respondents would benefit from multiple messages when selecting their home internet service plan. Consider marketing your fiber internet service with information that describes both speed and common internet activities as a way to connect with and convert a broader group of potential mid-tier customers who are ready to switch.

Shopping for Local Service

Our survey also asked respondents to rate the importance of two primary components: service factors and product attributes.

For more than 80% of mid- and fiber-tier respondents, the most important service factors were found to be reliability of service and responsive customer service. Over two-thirds of both groups stated that local customer service is highly important when choosing a provider.

Likewise, almost 80% of both mid- and fiber-tier respondents felt that the most important product attribute is having the lowest amount of service outages. This attribute speaks to both reputation and reliability and slightly edges out faster upload and download speeds and free networking hardware. As with the service factors, nearly two-thirds of both groups found local customer service locations to be highly important in selecting a home internet provider.

Building and maintaining your local brand reputation as an internet provider requires combining reliable service, low outages and a localcustomer-service presence. Finding the right honest mix for your brand is key.

Know Your Audience

Ultimately, mid- and fiber-tier respondents share similar attitudes in terms of what they value when shopping for their home internet. The two groups slightly diverged, however, in terms of what types of information would help them better make a decision. Mid-tier respondents are more likely to value information that helps them understand options based on common internet activities, while fiber-tier respondents are more likely to value speed option information. Still, both groups need both messages to be converted.

Throughout this four-part blog post series, Trone Research + Consulting in collaboration with Trone Brand Energy has examined how well US mid- and fiber-tier survey respondents understand their home internet, how they behave and why they become frustrated with their home internet connection. Fortunately, both groups are similar in most aspects—meaning converting mid-tier customers to fiber service is about developing a differentiated local or regional marketing strategy that speaks to the unique advantages found in each market.

These four articles just scratch the service of our insights and capabilities. If you’re really interested in developing the right marketing strategy to expand your fiber clientele, contact us today and let’s talk.

Before Your Next Promotion

- Do you know what your company reputation is within your various markets?

- What percentage of your marketing budget is focused on targeting mid-tier households?

- What fiber service and product attributes does your company market and how?