Home Sweet Connected Home

Based on a survey of nearly a thousand internet customers, more than 70% of mid- and fiber-tier respondents described their residence as a freestanding home. Just over 80% of mid- and fiber-tier respondents share their home internet with at least one other person (this number drops significantly for the basic tier).

Odds are likely that they are sharing service with a roommate or significant other, but what about kids? Only around one third of mid-tier respondents have at least one child under 18 in their household, compared to nearly half of all fiber-tier respondents.

As bandwidth becomes more of a household concern, marketing fiber as a proactive solution to growing households and multiple internet-connected devices could be effective at convincing mid-tier respondents to upgrade.

More Reliable Offer

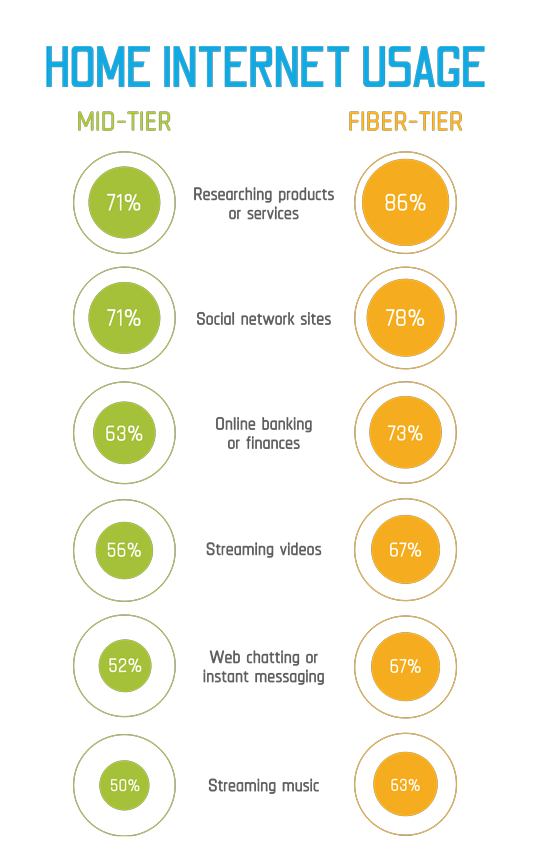

To better understand if mid- and fiber-tier customers differ greatly in terms of their home internet usage, our survey asked respondents to describe how frequently they used their internet for common activities like streaming video, video chatting and online gaming. The comparison chart illustrates that fiber-tier respondents tend to be more frequent internet users, but the types of activities actually mirror those of mid-tier respondents. The most frequently reported activity was researching products or services, with 86% of fiber-tier respondents and 71% of mid-tier respondents claiming to perform this task on a daily or weekly basis.

The marketing insight is that mid- and fiber-tier respondents engage in internet activities at similar frequency levels, so mid-tier customers will most likely be open to a messaging strategy centered on how fiber can increase the reliability of the most frequently performed internet activities for all members of their household.

Know Your Audience

Mid- and fiber-tier respondents heavily resemble each other in both household makeup and frequency of internet activities. But this is good news. It means the right strategic message can bridge the gap and help move mid-tier users into the fiber tier.

Part three of this series will examine the primary frustrations that mid- and fiber-tier respondents have with their home internet. In the meantime, please reach out to our agency, and we’ll help you understand how our research results can be applied to your audience for more awareness, conversions and marketing success. Missed part one? Check out our insights on customer confusion.

Before Your Next Promotion

- Do you know the makeup of your mid-tier customer households?

- What kind of households does your marketing target?

- What kind of internet activities does your fiber marketing reference?